Being in a skilled trade brings numerous benefits, such as the freedom to choose your projects and work schedule, not to mention the absence of a boss breathing down your neck in a stuffy office job.

That said, your role also demands careful financial management to ensure stability and long-term success. Effective money management is crucial for maintaining financial health, managing expenses, and achieving personal financial goals. So let’s explore some essential strategies to help you manage your money wisely.

Establish a Clear Financial Plan

Setting clear financial goals is the first step towards effective money management. As part of this, you should define both short-term and long-term objectives, such as saving for retirement, buying new equipment, or expanding your business.

By having specific goals in mind, you can create a roadmap for your finances and stay motivated to make sound financial decisions. Also, having a plan will motivate you to stay on course.

Keep a Budget and Stick To It

Creating a budget is essential for maintaining financial discipline. This will help you track your income and expenses to gain a comprehensive and up-to-date understanding of your financial situation.

Consider using accounting software or budgeting apps to simplify the process and generate better insights into your cash flow. These solutions can help you get a better understanding of your income and expenses by giving you an easy-to-understand overview of your financial situation.

Separate Business and Personal Finances

Keeping personal and business finances separate is vital to maintaining accurate records. Open a separate bank account exclusively for your business transactions. This will help you track income, expenses, and tax obligations more accurately.

It also ensures that personal and business expenses don't overlap, simplifying tax reporting and minimizing potential complications down the line, such as during tax audits. Separating business and personal finances will also help you create some mental distance between your work and your family life.

Save for a Rainy Day

Having an emergency fund is crucial to handling unforeseen circumstances, such as equipment repairs or a downturn in business. Your aim should be to save three to six months' worth of living expenses and keep these in an easily accessible form, such as cash.

If you choose to keep this money in precious metals or high-grade bonds, keep in mind that these can be volatile, especially during times of crisis and that liquidating them incurs a transaction cost. If you don’t have three to six months of living expenses, you can start by putting aside some amount of money every month.

Diversify Your Revenue Streams

Relying on a single source of income can be risky. As a result, you should aim to diversify your income by taking on different types of projects, collaborating with others, and exploring additional revenue streams. This approach not only increases your earning potential but also helps buffer your finances during slower periods.

That said, you must also find out what your niche is. What is the one thing that you are especially good at? What will other people recommend you for? Getting yourself into a profitable professional niche takes time and an ongoing commitment to professional development.

You should take the time to hone your professional edge while also exploring new revenue streams. This is the approach large companies like Amazon and Apple take, so you should do the same.

Find a Good Financial Advisor

Your time is limited, that’s why you should seek out skilled and hard-working financial professionals to help you make better financial decisions. Think of it as a way of optimizing your time use, which can be better spent on the job or with your family.

As a starting point, you should familiarize yourself with the different types of financial advisors and how they can help you.

In the US, there are:

- Certified Financial Planners (CFPs)

- Certified Public Accountants (CPAs)

- Investment Advisory Representatives (IARs)

Each has varying qualifications, compensation structures, and fiduciary responsibilities. It's important to understand the differences and choose an advisor who aligns with your needs and values.

To find a good financial advisor, you can also seek recommendations and referrals from trusted friends and colleagues - just like you do for work. Their firsthand experiences can provide valuable insights.

Additionally, you can consult professionals you already trust, such as accountants or attorneys, who may be able to recommend reputable and competent advisors.

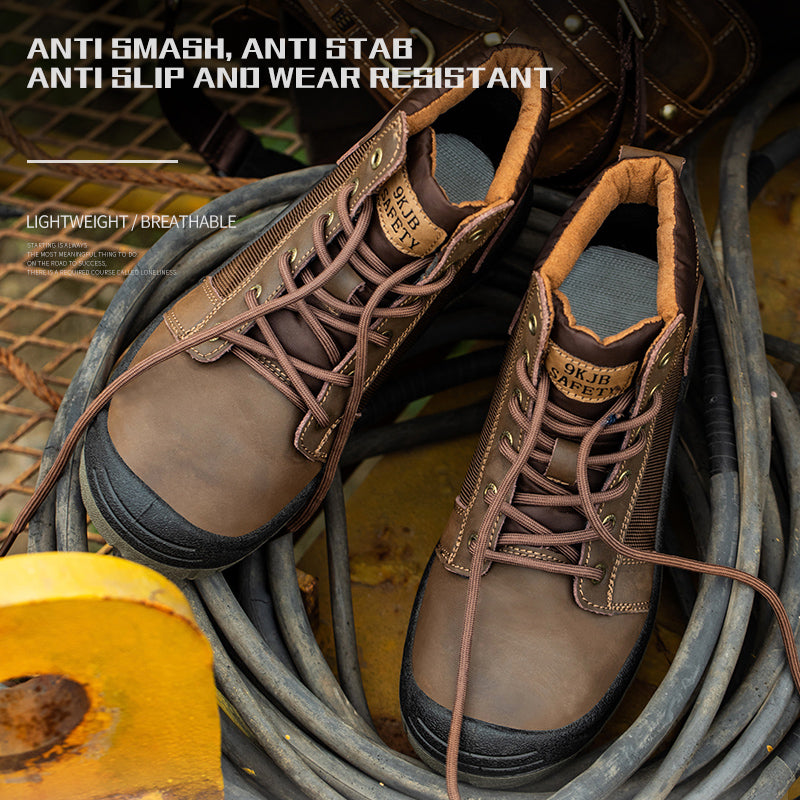

Step One: Wear Indestructible Shoes

Though life is full of compromises, your safety is one area where you cannot afford to take shortcuts. Having an accident and injury means lost time and therefore lost money.

Depending on how bad it is, time off due to an injury can have serious financial consequences for you and your family. So you need to minimize the risk of this happening. Part of this means protecting your feet, which, after all, carry you through the day. By keeping them safe from sharp surfaces, slippery floors, and falling objects, our shoes can help you do that.